Global Asset Allocation Views – Q1 2019

Quarter in Review

The 4th quarter of 2018 did not go as planned, though in reality nothing about investing truly ever goes to plan. The S&P 500 had just hit an all-time high and we were heading into historically what has been the strongest part of the calendar. Then Fed Chairman Jerome Powell spoke. An unscripted comment about how we are ‘a long way’ from neutral on interest rates and the rest is history. Many people still remember 2007 and how the Fed overzealously tightened. As the floodgates opened, under the radar events began to occur: 1) sentiment began to dampen as economic data came in lower than expected, 2) investors were busy harvesting losses and more eager to sell than to buy, and finally 3) institutional investors went missing as a large number of hedge funds closed up shop and algorithmic trading computers were having their support levels broken leading to forced selling. A selling stampede occurred and there was no liquidity to prop up the market.

The S&P 500, on a total return basis, finished the year in the red for the first time since 2008. The US Aggregate bond index closed flat for the year, while international markets fell even harder than domestic stocks as trade concerns, US Fed tightening, and a firm dollar all were significant headwinds for international companies. It is prudent to never overreact to short-term bouts of volatility.

Looking ahead in the short-term we are focusing on three areas:

- Earnings – will tell us how much the U.S. economy is slowing and the impact of tariffs and/or inflation.

- China – the escalation of tariffs put on by the U.S. has shocked an already slowing economy. China has begun to loosen their policy to hopefully stimulate growth.

- Brexit – the overpromising that led to Brexit is beginning to face reality. A no-deal Brexit would be painful and cause troubles on both sides of the English Channel.

Key Themes

- End of Cycle Outlook – the end of a business cycle is on the horizon in the intermediate-term and it is important to understand what that means for investors

- Increased volatility will become the norm

- Cyclical value sectors will outperform rate-sensitive sectors

- Reducing risk while maintaining a slight overweight tilt to equities over fixed income

- Focus on rebalancing to keep weightings close to target

- Late cycle returns tend to be strong and trying to time a recession or get into cash too early will hurt performance

Key Risks

- Federal Reserve – the Fed’s dot plot (expected rate hikes) has dropped to two versus three expected hikes for 2019. Inflation should remain subdued as oil prices have tumbled and economic data, outside of labor, has been weak as of late. The yield curve inverted at the 2s/5s part of the curve but this has no real significance. An inversion at the 3mo/10s part of the curve is a better recession predictor.

- Trade War – The current China U.S. trade skirmish is currently on hold until March 1st. There is definitely an opportunity for both sides to come to some kind of compromise to please their bases. On the downside the issues surrounding intellectual property theft and China’s alleged hacking of U.S. technology is a more complex and lasting issue that could remain at the forefront.

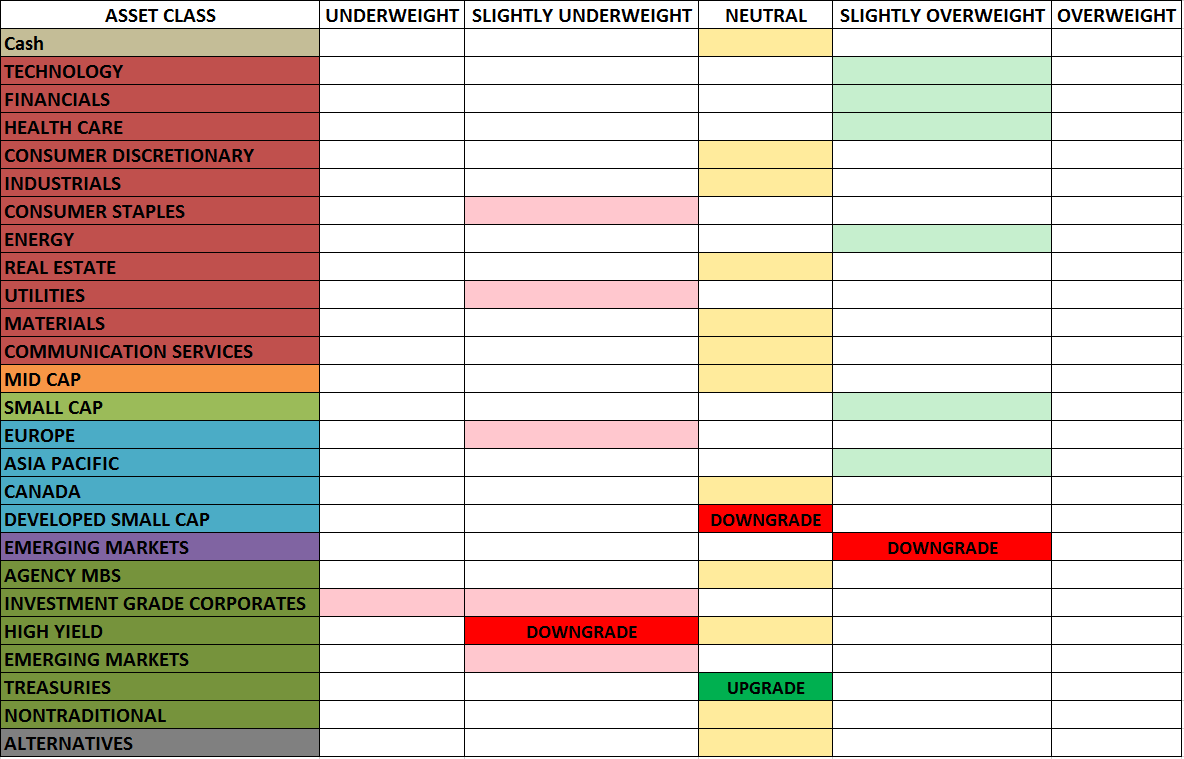

Model Changes

As I discussed earlier I continue to have a risk-on tilt, albeit, much smaller than it was a year ago. With that being said I have looked to reduce risk and provide some downside protection as I expect more volatility ahead.

Upgrades

Increased U.S. Treasuries to Neutral – as we continue to get volatility and muted inflation I have moved treasuries back to neutral to provide quality and safety within the portfolio.

Downgrades

Decreased High Yield Bonds to Slightly Underweight – I have chosen to take my risks in being overweight equity and have decreased the majority of the fixed income sleeve that is lower in quality to underweight.

Decreased Emerging Markets to Slightly Overweight and Decreased Developed Small Cap to Neutral – I still favor international equities and this is more to balance the model as these positions have pulled back and I am not looking to add at this time. Emerging Markets performed well in the 4th quarter outperforming U.S. and Developed Markets. This could bode well for their 2019 outlook.

Written by: Antonio Belmonte, CFA, Chief Investment Officer

These are the opinions of Antonio Belmonte and not necessarily those of Cambridge, are for information purposes only, and should not be construed or acted upon as individualized investment advice. Investing involves risk. Depending on the types of investments, there may be varying degrees of risk. Investors should be prepared to bear loss, including total loss of principal. The strategies discussed herein are not designed based on the individual needs of any one specific client or investor. In other words, it is not a customized strategy designed on the specific financial circumstances of the client. However, prior to opening an account, Cambridge will consult with you to determine if your financial objectives are appropriate for investing in the model. You are also provided the opportunity to place reasonable restrictions on the securities held in your account.